Liechtenstein Portugal Tax | 2

The communal tax varies depending where in the country you live. Only some of the chapters in this Tax Guide reflect COVID-19.

Taxes In Liechtenstein Hilti Headquarters

Liechtenstein Business Taxation and Offshore Information.

Liechtenstein portugal tax. What defines a tax haven is the fact that these rates are not extended to legal entities registered in the location that are owned by people not resident there. Liechtenstein residents are taxed on their worldwide income on a scale from 25 to 224 including communal and social security taxes. 1 The most important revenue sources include the income tax social security contributions corporate tax and the value added tax which are all applied at the national level.

A quick and efficient way to compare salaries in Liechtenstein review income tax deductions for income in Liechtenstein and estimate your tax returns for your Salary in Liechtenstein. It is seen also as an attempt to put pressure on. The property is directly and jointly owned by husband and wife.

The 2008 Liechtenstein tax affair is a series of tax investigations in numerous countries whose governments suspect that some of their citizens may have evaded tax obligations by using banks and trusts in Liechtenstein. The main taxes for individuals are income tax which is divided into national tax and communal tax and property profit tax. This tax is split between a national tax and a communal tax.

Liechtenstein and United Arab Emirates have initialed a tax treaty Liechtensteins Ministry for General Government Affairs announced March 4. The treaty largely follows the OECD Model Convention and provides for cooperation on tax matters between the tax authorities. The content is current on 1 January 2021 with exceptions noted.

Natural persons resident in Liechtenstein are subject to capital tax and income tax. Financial Year 1 January 31 December Currency Swiss Francs CHF. Although Liechtenstein is not part of the European Union good relationships to the EU are key to the nations economic success.

Up-to-date English-language version of the Tax Act and the Tax Ordinance these are unofficial translations for guidance only. Corporate Tax Rate 1250. Liechtenstein is in customs and monetary union with Switzerland and is part of EFTA and the EEA though it is not a UN.

Consequently the tax rate consists of the national tax rate combined with the surcharges which results in tax rates from 25 to 224. Taxes in Portugal are levied by both the national and regional governments of Portugal. Jurisdiction MLI Date signed Entry into force Effective date 1.

In order to preserve Liechtensteins sovereignty and data protection Swiss authorities cannot automatically allocate a UID to companies domiciled in Liechtenstein. Liechtenstein ranked 4th vs 65th for Portugal in the list of the most expensive countries in the world. The Liechtenstein Tax Calculator is a diverse tool and we may refer to it as the Liechtenstein wage calculator salary calculator or Liechtenstein salary after tax calculator it is however the same calculator there are simply so many.

This page was last updated on 28 May 2020. In addition VAT applies to most goods and services. Therefore Liechtenstein has reformed their tax systems to fully comply with EU tax good governance principles and has now been removed from the EU grey list of tax havens a good sign for the Blockchain community.

Capital gains tax in Portugal is charged on the sale of property or other assets at a rate of 28 for individuals and 25 for companies and non-residents. For individuals with a limited tax liability who are ordinary tax-assessed a general municipal multiplier of 200 will be applied. Capital gains taxes.

In arriving at effective capital gains tax rates the Global Property Guide makes the following assumptions. Austria na 05111969 07121970 01011969 3. The national tax comprises eight tax bands with a maximum of 8.

Residence A company is resident in Liechtenstein if it is incorporated in Liechtenstein or if the place of effective management is situated in Liechtenstein. In principle all corporations foundations and establishments are subject to a profit tax at a flat rate of 125. Basis of Taxation Resident companies are taxed on worldwide income.

This practice of charging tax to the local population bet. The average cost of living in Liechtenstein 2245 is 132 more expensive than in Portugal 967. PRINCIPALITY OF LIECHTENSTEIN List of all Double Taxation Agreements DTA as of 22 June 2021 No.

Chapter by chapter from Albania to Zimbabwe we summarize corporate tax systems in more than 160 jurisdictions. Personal Income Tax Rate 2240. Andorra na 30092015 21112016 01012017 2.

It is their only source of capital gains in the country. Resident companies are subject to unlimited tax liability on worldwide income. 1 Liechtenstein does charges taxes on its resident population albeit at moderate rates.

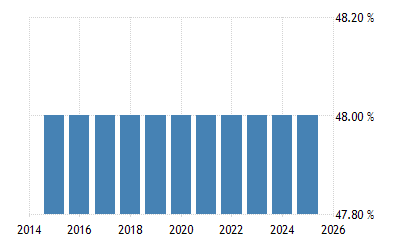

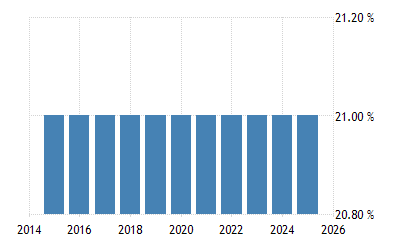

This is commonplace in a tax haven. Personal Income Tax Rate in Liechtenstein averaged 2080 percent from 2007 until 2020 reaching an all time high of 24 percent in 2015 and a record low of 1701 percent in 2008. Tax revenue in Portugal stood at 349 of GDP in 2018.

Responsibility for applying for a Swiss UID from the Office of Statistics Amt für Statistik AS therefore lies with Liechtenstein companies themselves. They have owned it for 10 years. The Personal Income Tax Rate in Liechtenstein stands at 2240 percent.

Liechtenstein is a constitutional monarchy sandwiched between Switzerland and Austria. Keep up-to-date on significant tax developments around the globe with EYs Global Tax Alert library here. Though Liechtenstein is a lightly taxed country there are no special regimes for the foreign employees of offshore companies.

A non-resident company generally pays taxes only on income. It has a land area of 160 km2 60 sq m and a population of 37009 July 2013 est. Liechtenstein Taxes Last Previous Highest Lowest Unit.

Non-resident companies are subject to limited tax liability on income from properties or. The affair broke open with the biggest complex of investigations ever initiated for tax evasion in the Federal Republic of Germany. The average after-tax salary is enough to cover living expenses for 27 months in Liechtenstein compared to 1 months in Portugal.

There is also a state tax and a municipal tax that varies according to the persons place of residence.

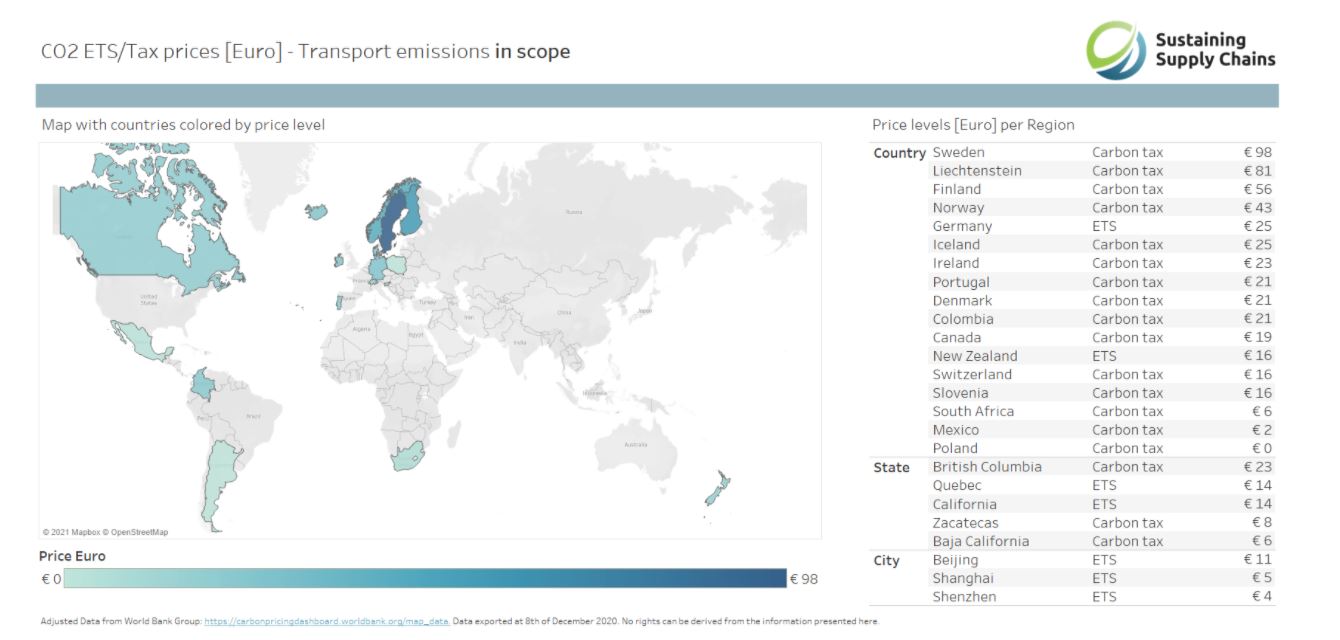

Co Beprijzing Verwacht Voor Transport In De Sport En Fashionbranche Fghs Logistiek

European Countries With A Carbon Tax Tax Foundation

Portugal Personal Income Tax Rate 2021 Data 2022 Forecast 1995 2020 Historical

2008 Liechtenstein Tax Affair Wikipedia

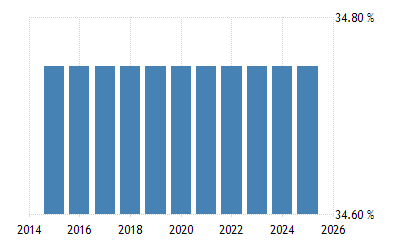

Portugal Social Security Rate 2021 Data 2022 Forecast 1981 2020 Historical

File Share Of Taxes And Levies Paid By Household Consumers For Electricity First Half 2020 V4 Png Statistics Explained

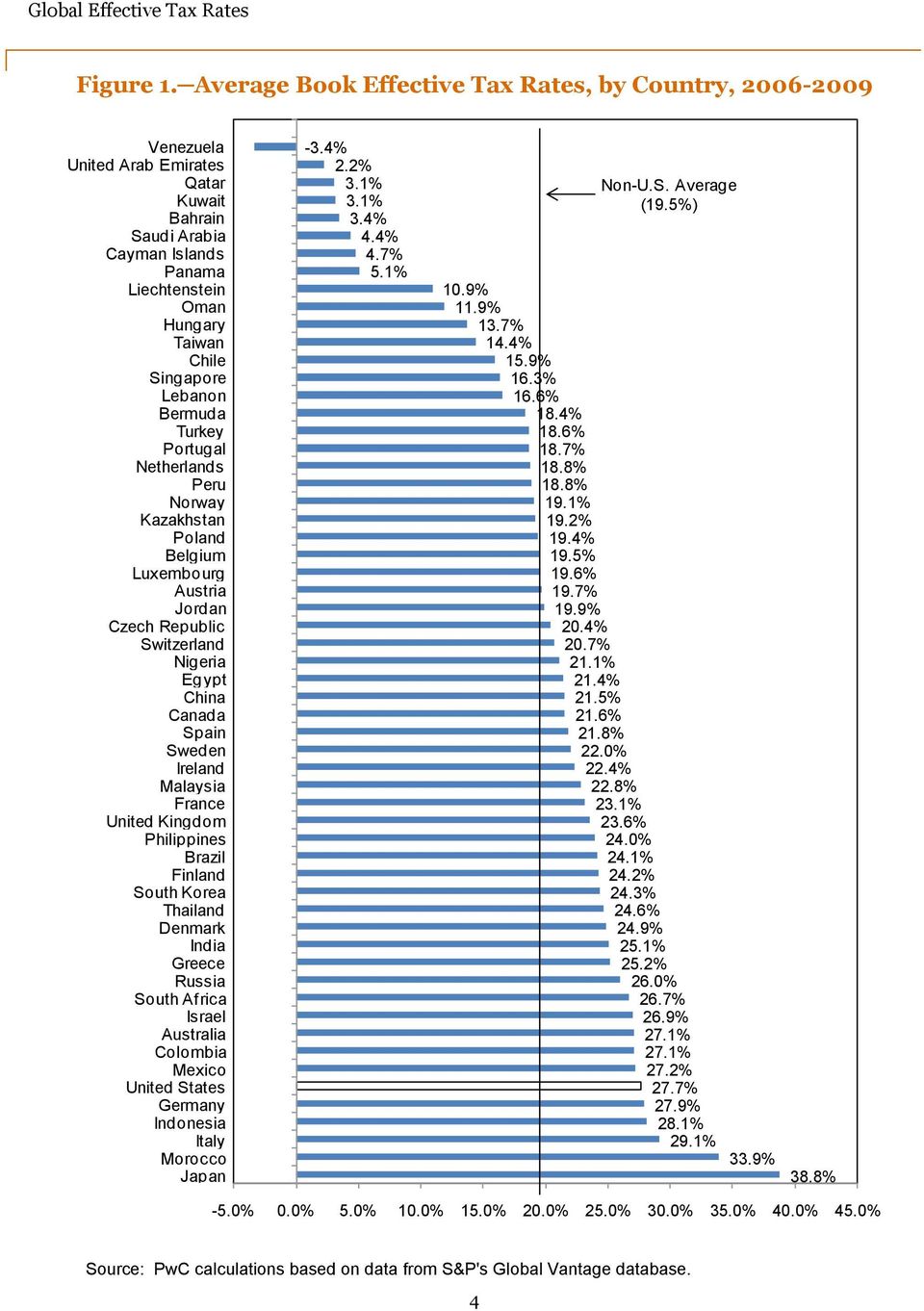

Global Effective Tax Rates Pdf Free Download

Portugal Corporate Tax Rate 2021 Data 2022 Forecast 1981 2020 Historical Chart

Pdf The Determinants Of Cross Border Tax Information Sharing A Panel Data Analysis Semantic Scholar

Liechtenstein Vs Portugal Comparison Cost Of Living 2021

Compulsory Tax Audit For Liechtenstein Banks Accounts Portugal Resident